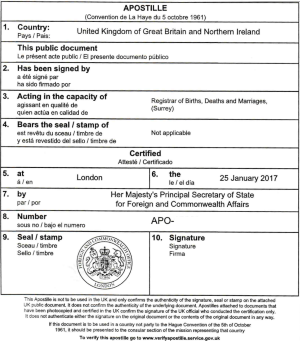

Certificate of Residence Apostille

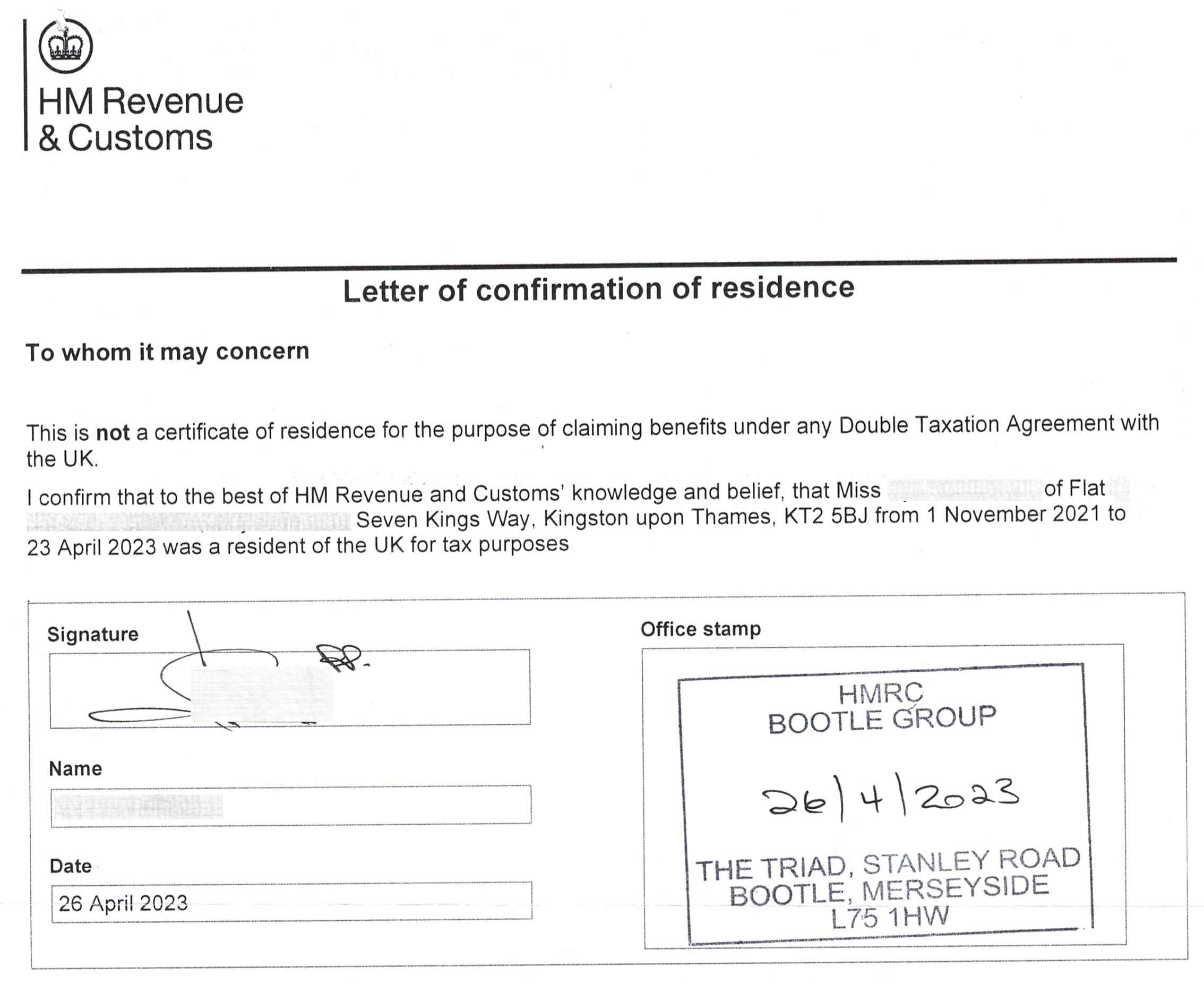

Certificate of Residence or Residency Letter is a document from HMRC that confirms that you are a UK resident for tax purposes.

Apostille serves as a verification of the HMRC official to claim tax relief on income earned in other countries or pension schemes.

Certificate of Residence Apostille Legalisation

Apostille for Certificate of Residency (CoR) can be issued to an individual, business, or charity.

Here are the steps on how to get an apostille for your Letter or Certificate of Residency from HMRC:

To apply for a certificate of residence to claim tax relief abroad, you can follow these steps:

- Go to the HMRC website and search for “certificate of residence“.

- Click on the link to the “How to get a certificate of residence” page.

- Read the guidance carefully and then decide whether you want to apply online or by post.

To apply online:

- Go to the “Apply for a certificate of residence” page.

- Sign in to your Government Gateway account.

- Complete the application form and answer all of the questions.

- Submit the form.

To apply by post:

- Download the “Residency Certificate ” form (APSS 146E) from the HMRC website.

- Complete the form and answer all of the questions.

- Send the form to the HMRC address that is printed on the form.

You may also need to provide supporting documentation, such as copies of your passport, driving license, and utility bills.

It may take several weeks for HMRC to process your application. Once you have received your certificate of residence, you can use it to claim tax relief on income earned in other countries. You will need to submit the certificate to the relevant tax authority in the other country.

Here are some additional tips for applying for a certificate of residence:

- Make sure that you have all of the required information and documentation before you start the application process.

- Answer all of the questions on the application form carefully and accurately.

- Proofread the application form carefully before submitting it.

- If you are applying by post, make sure that you send the form to the correct address.

Certificate of Residence Apostille for Businesses

A Certificate of Residency for business in the UK from HMRC is a document that confirms that a business is a resident of the United Kingdom for tax purposes. It can be used to claim tax relief on income earned in other countries and to avoid double taxation.

To apply for a certificate of residency for business, you will need to complete form APSS 146E. You can find this form on the HMRC website.

You may also need to provide supporting documentation, such as copies of your company’s incorporation documents, tax returns, and bank statements.

It may take several weeks for HMRC to process your application. Once you have received your certificate of residency, you can use it to claim tax relief on income earned in other countries. You will need to submit the certificate to the relevant tax authority in the other country.

Here are some tips for applying for a certificate of residency for business UK HMRC:

- Make sure that you have all of the required information and documentation before you start the application process.

- Answer all of the questions on the application form carefully and accurately.

- Proofread the application form carefully before submitting it.

- If you are applying by post, make sure that you send the form to the correct address.

Once you have received your certificate of residency, you need to legalise with an apostille in order you can use it to claim tax relief on income earned in other countries. You will need to submit the certificate to the relevant tax authority in the other country.

Here are some examples of situations where you may need a certificate of residency for business:

- Your business has a branch or subsidiary in another country.

- Your business earns income from investments in another country.

- Your business pays royalties or other fees to a company in another country.

- Your business is involved in a cross-border transaction, such as a merger or acquisition.

Business – Tax Residency Certificate

- When you apply for a Certificate of Residence (CoR) you must tell HMRC – why you need a CoR, the double taxation agreement you want to make a claim under, the type of income you want to make a claim for and the relevant income article, the period you need the CoR for, if different from the date of issue, if needed by the double taxation agreement, confirmation that you are – the beneficial owner of the income you want to make a claim for and that you are subject to UK tax on all of the income you want to make a claim for.

- If you are a newly incorporated company, who have not yet filed a Corporation Tax Return, you must tell HMRC the name and address of each director and shareholder, and the reason the company believes it’s a resident of the UK (guidance is in the International Manual at INTM120030)

A letter of residence from HMRC is a document that confirms that you are a UK resident for tax purposes. It can be used to claim tax relief on income earned in other countries.

To apply for a letter of residence from HMRC, you will need to complete form APSS 146E. You can find this form on the HMRC website.

You may also need to provide supporting documentation, such as copies of your passport, driving license, and utility bills.

It may take several weeks for HMRC to process your application.

Once you have received your letter of residence from HMRC, you can use it to claim tax relief on income earned in other countries. You will need to submit the letter to the relevant tax authority in the other country.

Here are some examples of situations where you may need a letter of residence from HMRC:

- You are a UK resident who works in another country.

- You are a UK resident who has income from investments in another country.

- You are a UK resident who is moving to another country and need to prove your UK tax residency.

- You are a UK resident who is applying for a loan or opening a bank account in another country.

Apostille cost for Certificate of Residence

All our Hague Apostille are issued by UK Government through FCDO (Foreign, Commonwealth and Development Office)

The price includes the Gov Tax, Admin and standard delivery (UK) – The Notary/Solicitor certification can be added when booking.

We guarantee the apostille on any UK Residence Certificate by our proven tracking and free expert advice.

Residency Certificate Apostille

Value 10-12 Days- GOV FEE

- ADMIN FEE

- FREE CHECK

Certificate of Residence Apostille

Standard 6-8 Days- GOV FEE

- ADMIN FEE

- FREE CHECK

Letter of Confirmation of Residence Apostille

Fast 3-5 Days- GOV FEE

- ADMIN FEE

- FREE CHECK

HMRC Residency Certificate

Next Day Apostille- GOV FEE

- ADMIN FEE

- FREE CHECK

We offer fast service, accurate translations for:

- Certificate of Residence Apostille

- Corporate Legal

- Health & Medical

- Manufacturing

- Travel & Tourism

- Westminster Apostille Translation

Cesidency Certificate Translation

- Any language

- Fast. Accurate. Confidential. Affordable.

- Accredited/Certified Translators

- All industries and subject matter

- Personalized services

- Translation of Documents and Written Materials