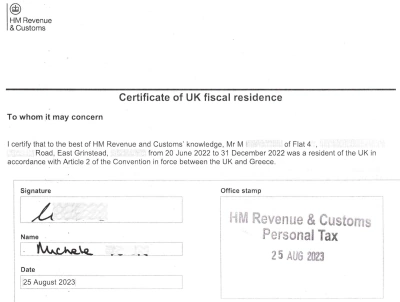

Certificate of UK Fiscal Residence

Certificate of UK Fiscal Residence (CoR) is a document issued by the UK tax authority, Her Majesty’s Revenue and Customs (HMRC), which confirms that an individual or company is a UK tax resident.

Must be apostilled before it can be used outside of the UK.

Certificate of UK Fiscal Residence Apostille can be used for a variety of purposes, such as:

• Claiming tax relief on foreign income in the UK

• Avoiding double taxation on income in the UK and another country

• Opening a bank account or applying for a mortgage in a foreign country

• Obtaining a visa or residency permit in a foreign country

HMRC letters and residency certificates can be obtained by applying online or by post. The application process is relatively straightforward, but there are some specific requirements that must be met. For example, applicants must provide evidence of their UK residency status, such as a copy of their passport or driving licence.

Once an application has been submitted, it will be processed by HMRC and a letter or certificate will be issued if the applicant is eligible. The processing time for applications can vary, depending on the volume of applications being received.

What is HMRC CoR

The HM Revenue & Customs (HMRC) issues a certificate of residence (CoR) to individuals, companies, or organizations. This certificate is required to claim tax relief abroad and avoid double taxation on foreign income. If you pay tax on your foreign income in the UK and you’re classified as a resident of the UK, you can apply for a CoR. The certificate is issued in line with the double taxation agreement between the UK and the country concerned. The overseas authority handling your claim will typically request HMRC to certify your UK residency. HMRC will not issue a CoR if you’re not entitled to treaty benefits under the double taxation agreement.

To apply for a CoR, you need to provide HMRC with information such as why you need it, the double taxation agreement you want to make a claim under, the type of income you want to claim for, and the period you need the CoR for. If you haven’t filed a Self Assessment tax return for the relevant period, you must also inform HMRC about the number of days you’ve spent in the UK during that tax year and other relevant details.

Please note that there is also a letter of confirmation of residence issued by HMRC. This letter confirms that an individual is regarded as a resident of the UK for purposes other than claiming relief from foreign taxes under the terms of a Double Taxation Agreement (DTA).

Here are some of the most common types of HMRC letters and residency certificates:

• Certificate of Residence (CoR): A CoR is a formal document that confirms a person’s tax residency status in the UK. It is typically used for claiming tax relief on foreign income in the UK or avoiding double taxation on income in the UK and another country.

• Letter of Confirmation of Residence (LoCR): An LoCR is a less formal document than a CoR, but it can also be used to confirm a person’s tax residency status in the UK. It is typically used for opening a bank account or applying for a mortgage in a foreign country.

• Statement of Residence (SoR): An SoR is a document that confirms a person’s UK residency status for the previous tax year. It is typically used for obtaining a visa or residency permit in a foreign country.

If you need an HMRC letter or residency certificate, you can apply online or by post. The application process is relatively straightforward, but it is important to make sure that you meet the eligibility requirements and that you provide all of the necessary information.

What is Double Taxation?

The HM Revenue & Customs (HMRC) issues a certificate of residence (CoR) to individuals, companies, or organizations1. This certificate is required to claim tax relief abroad and avoid double taxation on foreign income. If you pay tax on your foreign income in the UK and you’re classified as a resident of the UK, you can apply for a CoR. The certificate is issued in line with the double taxation agreement between the UK and the country concerned. The overseas authority handling your claim will typically request HMRC to certify your UK residency. HMRC will not issue a CoR if you’re not entitled to treaty benefits under the double taxation agreement.

To apply for a CoR, you need to provide HMRC with information such as why you need it, the double taxation agreement you want to make a claim under, the type of income you want to claim for, and the period you need the CoR for. If you haven’t filed a Self Assessment tax return for the relevant period, you must also inform HMRC about the number of days you’ve spent in the UK during that tax year and other relevant details.

For more information on how to apply for a certificate of residence, please visit Gov page.

Please note that there is also a letter of confirmation of residence issued by HMRC. This letter confirms that an individual is regarded as a resident of the UK for purposes other than claiming relief from foreign taxes under the terms of a Double Taxation Agreement (DTA).

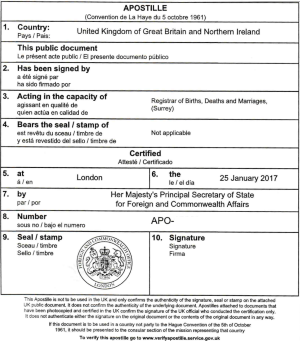

Apostille for Fiscal Residence

All our Hague Apostille are issued by UK Government through FCDO (Foreign, Commonwealth and Development Office)

The price includes the Gov Tax, Admin and standard delivery (UK) – The Notary/Solicitor certification can be added when booking.

We guarantee the apostille on any UK Fiscal Residence Certificate by our proven tracking and free expert advice.

Fiscal Residence Apostille

Value 10-12 Days- GOV FEE

- ADMIN FEE

- FREE CHECK

Apostille Fiscal Residence

Standard 6-8 Days- GOV FEE

- ADMIN FEE

- FREE CHECK

Certificate of Fiscal Residence Apostille

Fast 3-5 Days- GOV FEE

- ADMIN FEE

- FREE CHECK

HMRC Certificate of Fiscal Residence UK

Same Day Apostille- GOV FEE

- ADMIN FEE

- FREE CHECK

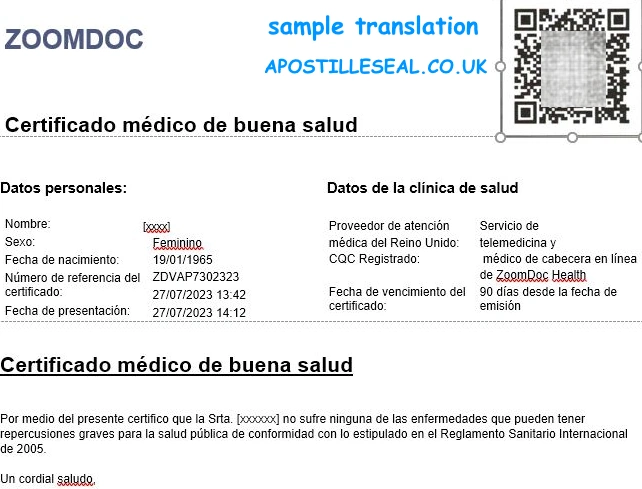

SWORN SPANISH EMBASSY TRANSLATION

- Spanish Visa Sworn Translation can only be done by a Sworn Translator appointed by the Ministry of Foreign Affairs (MAEC) and aprooved by Spanish Embassy. Be sure to order the translation to an Official Translator, or the translation will not be valid.

- Specialised in the certified translation of official documents such as birth certificates, criminal record certificates, academic transcripts, vaccination records, certificates of single status and/or non-divorced, marriage certificates or certificates of common-law unions, naturalisation certificates, bank letters of financial solvency, and apostilles.

We offer fast service, and accurate translations for:

- Apostille Degree, Master, Bachelor, Transcript

- Fiscal Residence Apostille Translation

Document Translation Services

- Any language

- Fast. Accurate. Confidential. Affordable.